Reduced Employment Ratio

The partial benefits due to reduced employment ratio was valid from the 15th of March 2020 until the the 31st of May 2021. Therefore, the resource has expired, but companies that had employees on partial benefits in April and May 2021 can apply for a grant due an increase in the employment rate.

Parliament has passed the Minister of Social and Children’s Affairs’ bill on the entitlement to the payment of unemployment benefits alongside reduced employment ratio due to temporary company recessions. The Act provides that wages paid alongside reduced unemployment ratio do not deplete unemployment benefits. The Directorate of Labour manages the applications for unemployment benefits due to reduced employment ratio.

From which date is the new legislation valid and for how long?

Application for unemployment benefits due to reduced employment ratio will be validated from the day that the employment ratio was reduced, or from the 15th of March at the earliest. This applies to both employees and self-employed individuals.

How and where can I apply?

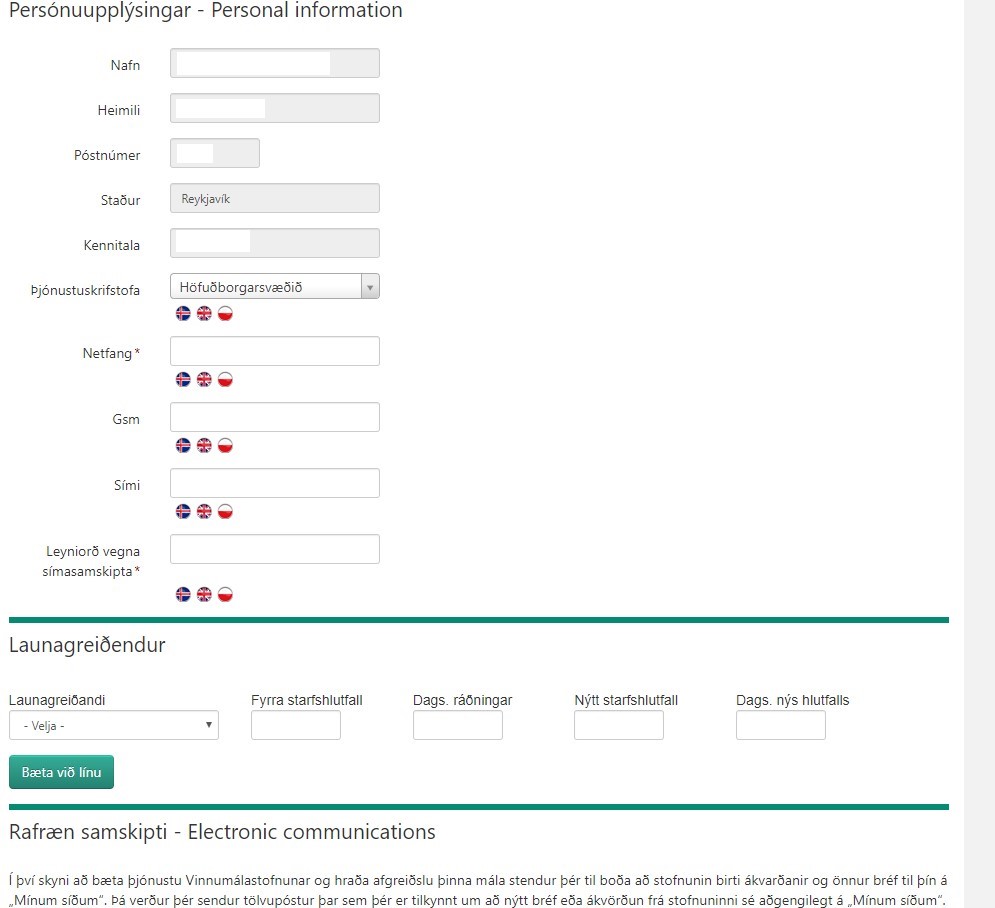

Employees who need to reduce their employment ratio, apply for payments from The Directorate of Labour via the pending application on ‘My pages’ (Mínar síður) for jobseekers. The employer submits a confirmation of reduced employment ratio and information regarding the employee’s intended wages via ‘My pages’ (Mínar síður) for employers.

What information do I as an employee need, to be able to apply?

Aside from providing your general personal information, i.e. phone number, email address and bank details, you will need to ensure that you know what the name of your employer is on the company registry (fyrirtækjaskrá) at Iceland Revenue and Customs (Skatturinn)

In the application for reduced employment ratio, you will find a drop-down list of the companies who have paid you wages in the last 6 months. Companies sometimes use other names in the Iceland Revenue and Customs’ company registry than those that they use day-to-day. Therefore, it could be that the name which appears on the list of employers in not necessarily the same as the day-today name of the company.

The Directorate of Labour does not possess any information other than the information obtained from Iceland Revenue and Customs’ company registry. You will need to contact your employer to obtain this information to ensure that you select the correct employer.

If you have not been paid by your employer in the last six months, the company’s name will not appear on the drop-down list. In this instance, you should select the last employer which appears on the list and send an email to greidslustofa@vmst.is. The email should stipulate your personal ID number (kennitala) and information regarding your current employer.

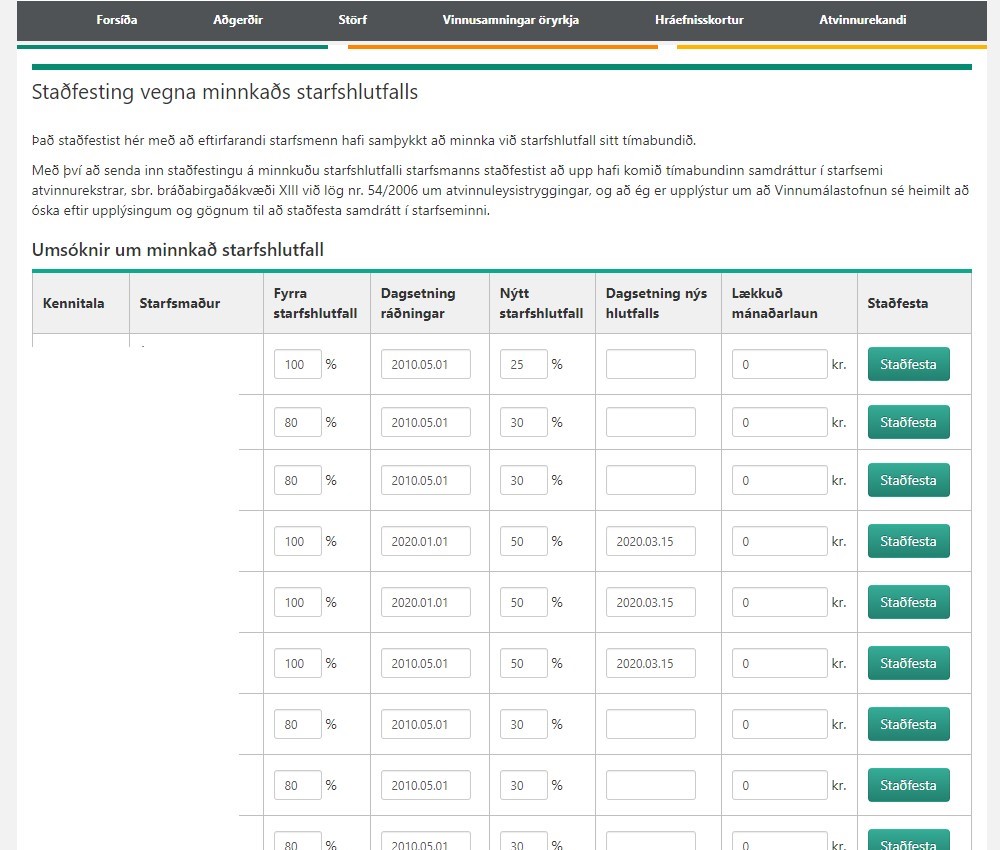

How does my employer submit the necessary information?

Employers are required to submit a confirmation of reduced employment ratio via ‘My pages’ for employers (Mínar síður fyrir atvinnurekanda) and have an Ice-key (Íslykill) or electronic ID (rafræn skilríki) for their business operations. Information about how the employer can obtain the Ice-key or electronic ID is available here: https://vefur.island.is/islykill/ and https://www.skilriki.is.

The employer is required to confirm the information that the employee has submitted in their application and register information regarding the employee’s intended wages from the company while in reduced employment ratio.

Further details

When the employee’s employment ratio has been reduced by at least 20% but not below 50%, the wages received for the reduced employment ratio do not deplete the unemployment benefits.

Payments from The Directorate of Labour amount to wage-indexed unemployment benefits in proportion to the reduced employment ratio. Wages from the employer and payments from The Directorate of Labour together may not however amount to more than 700.000 kr. Monthly wages for 100% employment up to 400.000 kr. are fully ensured.

The Directorate of Labour is currently working on producing a calculator to enable individuals to calculate their intended payments.

Entitlement to the Wage Guarantee Fund (Ábyrgðarsjóður launa)

In the event that the employer becomes bankrupt, the employee retains all entitlements to payments from the Wage Guarantee fund in proportion to the pervious employment ratio.

Where can I find the legal provisions?

The legal provisions are available on the Parliament’s website here: https://www.althingi.is/altext/150/s/1173.html